Documents Required

Invoice, Debit Notes, Bill of Entry

GST Input Tax Credit Reconciliation

GST input tax credit reconciliation and sending of SMS/email reminders to vendors.

- Basic

- GST Registration

- LEDGERS Accounting Software

Get in Touch

GST Input Tax Credit Reconciliation

What is input tax credit?

The input tax credit is the central tax (CGST), state tax (SGST), integrated tax (IGST), or cess that is paid by a person and has a GST registration on the supply of goods or services. GST input tax includes the tax that is paid on a reverse charge basis and the IGST charged on the import of goods. But, input tax does not include the tax paid on the composite taxation scheme.

The input tax credit is the tax paid by a business on the purchase and this tax is used to reduce the tax liability when a sale is made. The taxation levy is based on the value that is added at each stage of the supply chain until it reaches the consumer.

The Goods and the Service Tax Act is levied on the goods and the services based on the principle of value addition. To negate the cascading effect of the tax liability that is paid on the procurement of the raw materials, consumables, plants, and machinery, etc. This element of offsetting the tax liability is called the input tax credit.

Every person with a GST registration in the supply chain takes part in control, collects the GST tax, and remitting the amount that is collected. To avoid double taxation and the cascading effect of the tax input credit is provided to set off tax paid on the procurement of the raw materials, consumables, goods, or services that are used in the manufacturing, supply, and sale of goods or services.

The business can achieve neutrality using the input tax credit mechanism in the incidence of tax and ensure that the input tax element is not entering into the cost of production or the cost of supply of goods and services.

Eligibility criteria for Input tax credit

Who can claim input tax credit?

The input tax credit can be claimed by a person who is registered under GST only if he is meeting the conditions that are mentioned below:- The input tax credit can be claimed only by a person that has a GST registration and has filed the GSTR 2 returns.

- The dealer should possess the tax invoice or the debit note that is issued by the supplier of input or the input services.

- The said goods or services or both should be received.

- The supplier has made the GST payment that is charged to the government concerning such supply.

- When the goods are received in installments the input tax credit can be claimed only when the last lot is received.

- No Input tax credit is allowed if depreciation has been claimed on the tax component of a capital good.

Documents required for claiming GST Input tax credit

What documents are required for claiming the GST input tax credit?

As a registered taxable person the input tax credit can be claimed on basis of the following documents:

step:1 An invoice that is issued by the supplier of goods or services

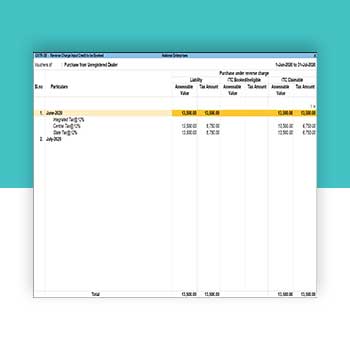

step:2 An invoice that is issued by the recipient of the goods and services supplied by an unregistered dealer. Such supply comes under the reverse charge mechanism. This mechanism involves the supplies made by an unregistered person to a registered person.

step:3 A debit note that is issued by the supplier of the tax charged is less than the tax payable concerning such supply.

step:4 A bill of entry or similar documents is also required to document an integrated tax on imports.

step:5 An invoice or the credit note that is issued by an input service distributor as per the rules under GST.

step:6 A supply bill by a dealer that is opting for a composition scheme or an exporter or a supplier of the exempted goods.