Documents Required

PAN Card

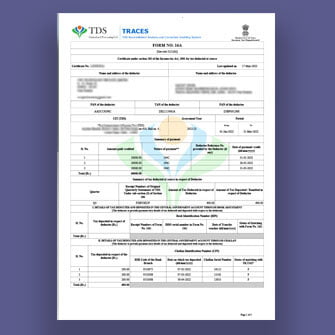

TDS Certificate

TDS Return Filing

- Tax & HR Assist Accountant

- GST Return Filing

- TDS Return Filing

- Income Tax Return Filing

- Payroll Processing

- PF Return Filing

- ESI Return Filing

- LEDGERS Platform

- LEDGERS HRMS

Get in Touch

TDS Return Filing

Tax deducted at source or TDS is the tax that is collected by the Government of India at the time when a transaction takes place. Here, in this case, the tax is to be deducted at the time the money is credited to the payee’s account or at the time of payment whichever happens earlier.

In this case of salary payment or the life insurance policy, the tax is deducted at the time when the payment is done. The deductor is required to deposit this amount with the Income Tax Department. Through TDS a portion of the tax is paid directly to the Income Tax Department. The Tax is deducted usually over a range of 10%.

Due Date for TDS Return filing

| Quarter | Period | Last Date of Filing |

|---|---|---|

| 1st Quarter | 1st April to 30th June | 31st July 2022 |

| 2nd Quarter | 1st July to 30th September | 31st October 2022 |

| 3rd Quarter | 1st October to 31st December | 31st Jan 2023 |

| 4th Quarter | 1st January to 31st March | 31st May 2023 |

Eligibility Criteria

Who can file TDS returns?

TDS return filing is done by organizations or employers who have availed a valid tax collection and deduction number (TAN). Any person who is making specified payments mentioned under the Income Tax Act is required to deduct the taxes at the sources and they are needed to deposit the tax within the stipulated time for making the following payments.

- Salary Payment

- Income on securities

- Income by winning the lotteries, puzzles, and others.

- Income from winning horseraces

- Insurance commissions.

- Payment concerning the National saving scheme and many others.