EWay Bill

Standard eWay Bill Solution

Documents Required

Supply of Goods, Transport ID, Transport Document

Get in Touch

eWay Bill

What is an eway bill?

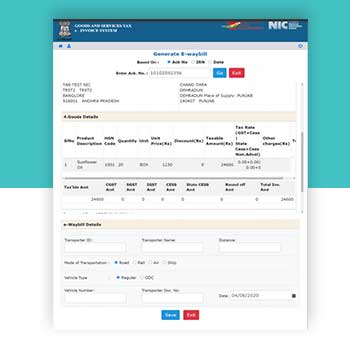

e-way bill is short for Electronic Way Bill. GST E-way bill is a document used to track goods in transit introduced under the Goods and Service Tax. A taxable person registered under GST involved in the transportation of goods with a value of over Rs.50,000 must possess an E-way bill generated on the GST Portal.

LEDGERS has made E-way bill generation and management very simple for business. The Ledgers E-way bill tool is synced to GST invoices, bills of supply, purchases invoices, and customer or supplier accounts.

eWay Bills can be generated seamlessly at the click of a button and shared with the customers or suppliers. The procedure for moving the movements of goods is prescribed in the E-way bill rules. However, it is to be noted that when the GST Act came into being on the 1st of July, the E-way bill implementation was deferred.

Who should Generate an eWay Bill?

- eWay Bills generation is done when there is a movement of goods of more than Rs.50,000 value to or from a registered person. The registered person can even generate an E-way bill if the goods’ valuation is less than Rs.50,000.

- An unregistered person is also required to generate an E-way bill. When an unregistered person makes a supply to a registered person, the receiver must ensure that all the compliances are complied with.

- A transporter carrying goods via road, air, rail, etc., is required to generate an E-way bill if the supplier has not generated any E-way Bill.

Documents required to generate eWay Bills

What documents are required to generate an E-way bill?

- Invoice/ Bill of supply/ Challan relevant to the consignment of goods

- In case of Transport by road- Transporter ID or the vehicle number

- Transport by rail, air, or ship- Transporter ID, Transport document number, and date.