Form 16 Issuance

Get in Touch

Form 16 Issuance to Employees

Form 16 is a certificate that employers issue to their employees. It is a validation that the TDS has been deducted and deposited with the government authorities on behalf of the employee of the organization.

Form 16 gives a detailed summary of the salary paid to the employees and the deducted TDS. TDS Form 16 contains all the information that an individual needs to prepare and file the income tax return.

The employers are required to issue a Salary TDS certificate every year on or before the 15th of June of the coming year immediately after the financial year in which the tax is deducted. There are two components of Form 16 Part A and Part B. If an individual loses Form 16 he can request a duplicate Form from the employer.

Structure of Form 16

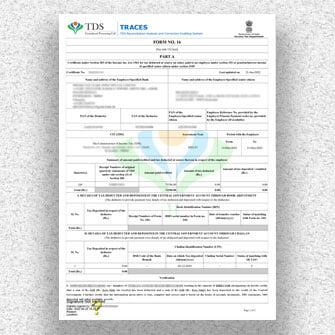

Part A of Form 16

It provides the details of the TDS that is deducted and deposited. This form can be generated by the employers through the TRACES portal.

The employer must verify the contents before issuing the certificate. Here are a few components of Part A of the salary TDS certificate.

- Name and address of the employer

- TAN and PAN of employer

- PAN of the employee

- Summary of tax deducted and deposited quarterly, which is certified by the employer.

Part B of Form 16

It is an annexure to Part A, Part B is prepared by the employer for its employees and it contains details of the breakup of the salary deductions approved under Chapter VI-A. In case of a job change in one financial year, Form 16 should be obtained by both employers. Some of the components of Part B are:

- Detailed breakup of salary

- Detailed breakup of exempted allowances under Section 10

- Deductions that are allowed under Income Tax Act (Under Chapter VIA)

Who is not eligible to file ITR 3 Form?

In case if the individual or the Hindu Undivided Family is functioning as a partner of the partnership firm that is carrying out business or profession then he cannot file form ITR 3 as he will be eligible to file Form ITR 2.