Documents Required

Electricity Bill, Telephone Bill, Property Tax Receipt

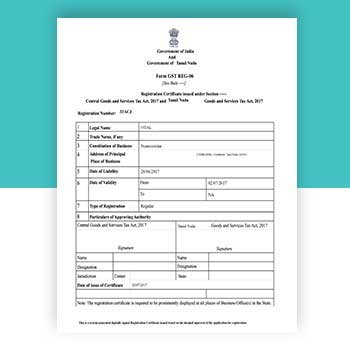

GST Registration

End-to-End Assistance* for GST Registration Services in Delhi and ensure to have harmonious process for Invoicing, E-invoicing and filing through software.

- Company

- GST Registration

- GST Invoicing

- GST E-Invoicing

- GST Filing Software

Get in Touch

GST Registration Services in Delhi

The Goods and Services Tax (GST) is a tax on goods and services consumed in India. GST is an indirect tax that has replaced many other indirect taxes in India, such as excise duty, VAT, and services tax. GST has been in force from 1st July, 2017 based on the Goods and Service Tax Act passed by the Indian Parliament on March 29, 2017. GST Consultant and Regular Compliance – CA Vishal Madan provides GST Consultancy & Regular Compliance, GST Registration Services in Delh

Taxable person under GST

A ‘taxable person’ under the GST Act is someone who conducts business in India and is registered or needs to be registered under the GST Act. A taxable person can be an individual, HUF, company, firm, LLP, an AOP/ BOI, any corporation or Government company, body corporate incorporated under the laws of a foreign country, co-operative societies, local authorities, governments, trusts, or artificial juridical persons.

GST Registration Turnover Limit

GST registration can be obtained voluntarily by any person or entity irrespective of turnover. GST registration becomes mandatory if a person or entity sells goods or services beyond a certain turnover.

Service Providers: Any person or entity who provides service of more than Rs.20 lakhs in aggregate turnover in a year is required to obtain GST registration. In special category states, the GST turnover limit for service providers has been fixed at Rs.10 lakhs.

Goods Suppliers: As per notification No.10/2019 any person who is engaged in the exclusive supply of goods whose aggregate turnover crosses Rs.40 lakhs in a year is required to obtain GST registration. To be eligible for the Rs.40 lakhs turnover limit, the supplier must satisfy the following conditions:

- Should not be providing any services.

- The supplier should not be engaged in making intra-state (supplying goods within the same state) supplies in the States of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikkim, Telangana, Tripur and Uttarakhand.

- Should not be involved in the supply of ice cream, pan masala or tobacco.

If the above conditions are not met, the supplier of goods would be required to obtain GST registration when the turnover crosses Rs.20 lakhs and Rs.10 lakhs in special category states.

Special Category States: Under GST, the following are listed as special category states – Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand.

Aggregate Turnover: Aggregate turnover = (Taxable supplies + Exempt Supplies + Exports + Inter-State Supplies) – (Taxes + Value of Inward Supplies + Value of Supplies Taxable under Reverse Charge + Value of Non-Taxable Supplies).

Aggregate turnover is calculated based on the PAN. Hence, even if one person has multiple places of business, it must be summed to arrive at the aggregate turnover.

Key GST registration Services offered at Vishal and co.

Our GST registration services in Delhi include following responsibilities which make us the most chosen CA firm-

Registration of GST- Businesses receive effective assistance from Vishal Madan and his team in registering for GST. They assist clients with every step of the registration procedure, making sure that all required paperwork is in order and that the application is filed appropriately to the GST authorities.

Turnover Assessment: The team assists companies in determining if GST registration is necessary or advantageous for them based on their turnover.

Professional Advice: CA Vishal Madan and his associates offer experienced guidance and keep customers up to date with any recent modifications to make sure their businesses are GST compliant.

Assistance with Paperwork: A number of documents are required for the GST registration procedure, including PAN, Aadhar, evidence of business registration, bank account information, and more. The team of Vishal and co. helps firms efficiently gather and arrange these documents.

Returns Filing: Filing GST returns is a critical component of compliance. we makes sure that GST returns are filed on time and accurately, lowering the possibility of fines or legal troubles.

Book your tax consultation with CA Vishal Madan for GST registration service in Delhi

CA Vishal Madan and his team provide superior GST registration services which simplifies tax compliance for businesses and allowing them to focus on their main operations. For the best GST registration services in Delhi, get in touch with us right away. Businesses may remain on top of the constantly changing GST landscape and guarantee easy tax regulation compliance through the use of our taxation services.

GST REGISTRATION SERVICES IN DELHI

GST and its role for every individual

The Goods and Services Tax (GST) is an indirect tax reform in India that aims to combine many levies under one elaborate tax system. The taxes landscape has undergone a substantial transformation, and the procedure for enterprises has been made simpler. Businesses that fulfill particular turnover requirements imposed by the government are required to register for GST. In order to avoid legal repercussions and reap the benefits of input tax credits, it is crucial for businesses to adhere to the GST law. Businesses who register for GST can take advantage of a number of advantages, such as easy interstate transactions, legal recognition, and easier tax compliance. If you are looking for GST registration services in Delhi, Vishal and co. is a best choice you can make. We are a CA firm providing full-fledged taxation services.

CA Vishal and co.- GST Registration Services in Delhi

GST registration is a crucial necessity for all businesses this is where CA Vishal Madan and his team’s experience come into effect. They provide trustworthy and effective GST registration services in Delhi due to their unrivalled knowledge and experience. CA Vishal Madan help assisting businesses in smoothly navigating the difficulties of GST compliance. Renowned chartered accountant CA Vishal Madan has a wealth of knowledge in tax preparation and accounting services. His team of professionals provides thorough GST registration services in Delhi, meeting the varied needs of companies in various industries. Their services are customized to meet your unique needs, whether you are a startup, small business, or huge enterprise.