Documents Required

Electricity Bill, Telephone Bill, Property Tax Receipt

Accountant & Invoicing Software

1 time setup and activation fee on LEDGERS. Rs.0.5 per eInvoice.

- Basic

- GST Invoicing

- GST eInvoicing

- eWay Bill

- Input Tax Credit

- GST Software for Accountants

- Integrated payment gateway

Get in Touch

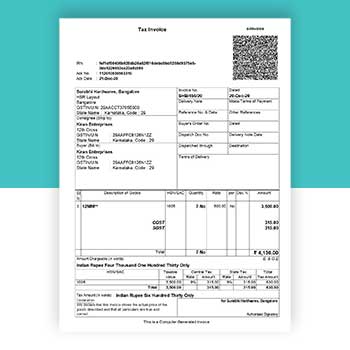

GST eInvoice

GST eInvoice has been introduced in India to usher in the digital era from conventional paper-based systems. eInvoicing can help businesses achieve tremendous cost savings, efficiency and speed up business operations. eInvoicing will help reduce compliance burden for most businesses by eliminating the requirement for duplication or transfer of the same information from one system to another. With eInvoicing, the invoice information provided to GSTN for generating Invoice Reference Number (IRN) would be used to auto-populate various other systems GST returns, input tax credit reconciliation, eWay bill and GST refunds. Hence, GST eInvoicing will significantly improve the ease of doing business and reduce the compliance burden.

eInvoicing Implementation Date

The proposal for implementing eInvoicing was placed before the 35th GST Council Meeting in June, 2019. The GST Council provided an in-principle launch of a pilot project on voluntary basis for online generation of B2B e-invoices from January 2020.

| Timeline | Turnover | Supply Type | Implementation |

|---|---|---|---|

| January, 2021 | GST registered entities having an aggregate turnover of more than INR 100 crores. | B2B | Voluntary |

| April, 2021 | GST registered entities having an aggregate turnover of more than INR 50 crores. | B2B | Voluntary |

| April, 2021 onwards | GST registered entities having an aggregate turnover of more than INR 20 crores. | B2B | Mandatory |

- An Insurer, Banking Company or Financial Institution including NBFC

- Goods Transport Agency

- Passenger Transport Service

- Admission to exhibition of Cinematograph Films in Multiplex Screens