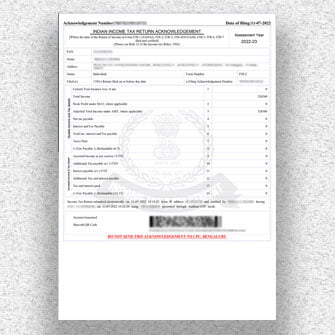

ITR-2 Return Filing

- Documents Required

- Form 16

- Bank Statement

Get in Touch

ITR 2 Form Filing

ITR 2 Form is an Important form income tax return form that is used by the Indian Citizens as well as the NRIs to file the return with the Income-tax department of India. The taxpayers who are not eligible to file ITR 1 can file ITR 1 to file the income tax returns. ITR 2 can be filed by individuals and Hindu Undivided Families who have their income for the financial year through salary, pension, more than one property, income from capital gains, income from foreign assets, business or income from a profession as a partner and other sources that include lottery, Racehorses, legal gambling.

Who can file Form ITR-2?

ITR form 2 can be filed by individuals and the HUF who are not eligible to file form ITR-1 receiving income from the “profits and gains from business or profession”. Thus persons having come from the following sources are eligible to file Form ITR 2:

- Income from Salary/Pension

- Income from House property ( can be from more than one house property)

- Income from Capital gains

- Income from other sources (Lottery, bets on horses, and other gambling)

- Foreign Assets/Foreign Income

- Agricultural income more than Rs.5000

- A resident is not an ordinary resident and an NRI.

- Also, a director of any company and an individual who is invested in unlisted equity shares of a company should file their returns in ITR-2

Who is not eligible to file Form ITR-2?

- Any individual or Hindu Undivided Family with income that is fully or partially earned from the business or profession.

- Individuals that are eligible to file ITR 1 Form.

- Individuals who are partners in a Partnership Firm.