Documents Required

Rental Agreement, if any

Proof of Rental Income if any

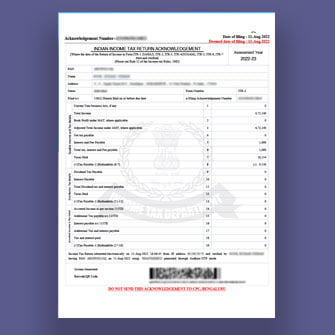

ITR-3 Return Filing

- Basic Accountant

- Income Tax Return Filing

- Tax Assist Accountant & HR

- GST Return Filing

- Income Tax Return Filing

- LEDGERS Platform

Get in Touch

ITR 3 Form Filing

ITR 3 Form is applicable for the individuals and Hindu Undivided Families that earn profit and gains from business or profession.

If the individual or the Hindu undivided family is having an income as a partner of a partnership firm that is carrying out business then ITR-3 cannot be filed as in such cases the individual is required to file ITR-2.

Eligibility for filing ITR 3 Form

Who can file ITR 3?

ITR 3 For is to be filed by the individuals and the HUFs who earn income from carrying a profession or from a proprietary business. ITR 3 Form can be used when the income of the assessee falls in the categories that are mentioned below:

- Income from carrying a profession

- Income from proprietary business

- Apart from this, the returns of the business can also include the house property, the salary or pension, and the income from other sources.

Who is not eligible to file ITR 3 Form?

In case if the individual or the Hindu Undivided Family is functioning as a partner of the partnership firm that is carrying out business or profession then he cannot file form ITR 3 as he will be eligible to file Form ITR 2.