Documents Required

Bank Statement

PAN Card

Aadhar Card

PAN Card

Aadhar Card

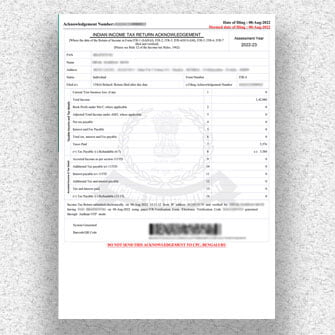

ITR-4 Return Filing

Get a Dedicated Accountant and LEDGERS compliance platform for your business.

- Basic Accountant

- Income Tax Return Filing

- Tax Assist Accountant & HR

- GST Return Filing

- Income Tax Return Filing

Get in Touch

ITR 4 Form Filing

Form ITR 4 is filed by the taxpayers who have opted for the Presumptive Taxation Scheme under Section 44D, 44DA, 44AE of the Income Tax Act,1961. But this is subject to the business turnover limit i.e in case if the turnover is exceeding Rs.2 crore then the taxpayer is required to file ITR 3 Form.

What is Presumptive Taxation in Scheme?

Presumptive Taxation Scheme is a scheme that exempts small taxpayers from maintaining the books of accounts.

Who is Eligible to file Form ITR 4?

Individuals whose income comes from the following sources have to file ITR 4 Form:

- Business Income under Section 44AD/Section 44AE.

- Income from a profession as per Section 44ADA.

- Income up to Rs. 50 lakh from Salary or Pension.

- Income up to Rs. 50 lakh from One house property (that does not include the brought forward loss o loss that is to be brought forward under this head)

- Income from other sources up to Rs.50 lakh (does not include winning from lottery or horse races)

- Form ITR 4 can also be filed by the freelancers if the income is not exceeding Rs.50 lakh.