Documents Required

Monthly Purchase Bill

Monthly Sales Bill

Sales Return Details

Monthly Sales Bill

Sales Return Details

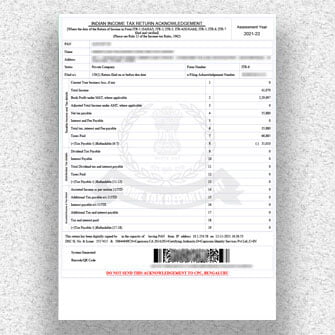

ITR-6 Return Filing

Income tax return filing for Companies whose annual turnover is upto Rs.10 lakhs.

- Basic

- Profit & Loss Accountant preparation

- Balance sheet preparation

- Dedicated Accountant Support

Get in Touch

ITR 6 Filing Form

ITR 6 Form is to be furnished by the Companies to e-file the income tax returns if they are not claiming exemption under Section 11 of the Income Tax Act 1961. Under the Income-tax Rules, the Companies that can claim an exemption under section 11 are those that have income from the property that is held for the charitable or religious person.

Hence, ITR 6 is to be filed by the companies that do not claim an exemption under section 11.

Efiling audit reports

If in case the assessee is liable for the audit u/s 44AB and the accountant has audited the accounts, then the details of the audit report, the auditor along with the date of furnishing is to be sent to the department electronically.

Who is eligible to file ITR 6 Form?

- ITR 6 Form is to be filed by every company irrespective of its structure registered under the Companies Act 2013 or the earlier Companies Act 1956. However, the companies whose source of income comes from the property that is held for religious or charitable purposes are not required to file ITR 6 Form.

- If the sales, turnover, or gross receipts are more than Rs.1 crore in the preceding financial year the entity must get the accounts audited from a certified Chartered Accountant.